Expect More On Your Investments

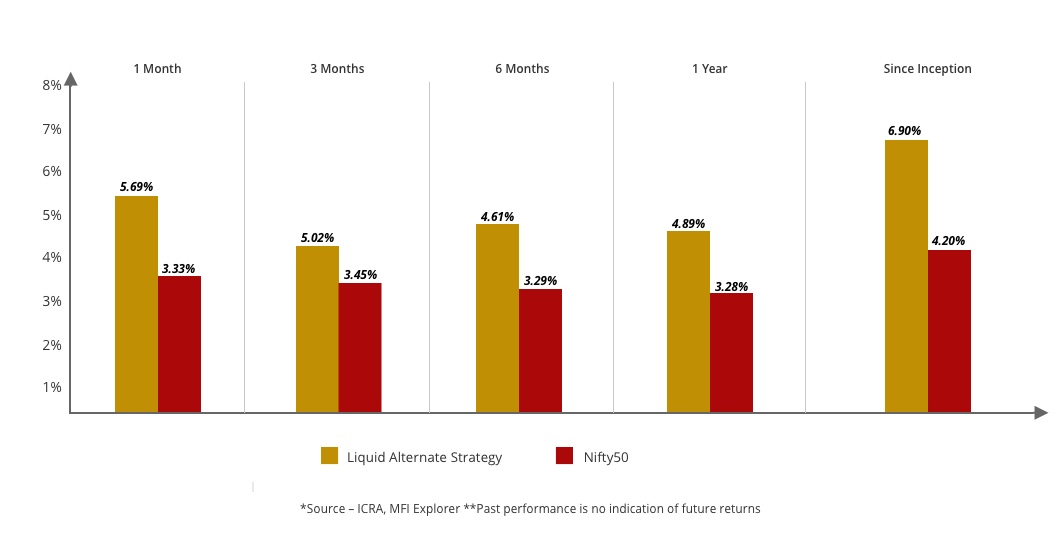

Get higher returns than Liquid Funds with Liquid Alternate Strategy

Introduction

Through Liquid Alternate Strategy, we aim to take advantage of steepness in the money market yield curve.

The fund follows a roll down strategy and generates capital gains if the rate drops or spreads compress.

Investment Philosophy

Buy 9-12 months instruments, and sell after 3-6 months, given the steepness available

Investments are into high quality & liquid bonds/CPs with less than 1 year residual maturity

Ideal for tenor between 3 to 12 months

Key Attributes

|

Credit control through customized portfolios |

|

Yield pick-up with ability to take advantage of yield curve steepness |

|

Potential for capital gains through roll down leading to higher returns |

|

No commingling impact like in mutual funds |

|

As liquidity improves, spreads will likely compress, leading to an added benefit |